owe state taxes but not federal

If you had taxes taken out you need to file for IRSstate so you can get a refund if you didnt then your below the the threshold on both federal and your state. If you made 7k.

How Do State And Local Individual Income Taxes Work Tax Policy Center

Take Advantage of Fresh Start Options.

. End Your IRS Tax Problems - Free Consult. Last year we paid 1200 to Delaware. Ad See if you ACTUALLY Can Settle for Less.

This return determines what you owe in state income taxes. Another potential issue resulting in owed taxes is the failure to file them on time. You have to pay federal income taxes but not state taxes.

You can pay by check or money order with a payment voucher Form. Free Confidential Consult. Get Your Max Refund Today.

So it doesnt matter what state you live in you still have to deal with federal taxes. Ad Use our tax forgiveness calculator to estimate potential relief available. Im not going to lie though its probably.

If you have taxes owed in the File section of the program you are given options on how you want to pay. Question from Joy April 13 2008 at 449pm I have a 72300 refund from the federal taxes but owe over 30000 for the state. Its possible especially if you had little or no state tax withheld.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. In contrast other states set minimum income levels. If you find yourself in a position where you have no federal tax obligation but owe state taxes it is probably because your states deductions and tax rates are not as.

Ad Help With Unpaid Taxes Unfiled Taxes Penalties Liens Levies Much More. Households paid no federal income taxes for 2021 up substantially from the 44 before the pandemic. States like Nevada and Wyoming dont charge state income taxes.

The amount of state and local income tax you pay will depend on how much income you earn and the tax rate of the state or locality where you live. When the amount of your tax refund is more than the state income tax you owe youll receive a payment through direct deposit or a paper check -- whichever method you. See if you ACTUALLY Qualify.

I only made 210000 this past year and dont. For instance a few years ago the. To find out how much.

The income brackets are subject to change over time. Tax Relief up to 96 Quote From Trusted BBB Member. File Your Federal And State Taxes Online For Free.

Ad Our Tax Relief Experts Have Resolved Billions in Tax Debt. Since my income is very low why is that the case. Affordable Reliable Services.

Owe IRS 10K-110K Back Taxes Check Eligibility. Get Your Maximum Refund With TurboTax. See if you Qualify for IRS Fresh Start Request Online.

Just now. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. If you live in a state that assesses income tax then youll need to file a state return along with your federal return.

The nonpartisan Tax Policy Center estimates that 57 of US. In years past we would get a very small refund from NJ but would owe at least a couple hundred in Delaware. Ad BBB Accredited A Rating.

You May Qualify For An IRS Hardship Program If You Live In New Jersey. Can I owe state taxes but not federal taxes. Generally speaking the annual due date for federal taxes is April 15 May 17 in 2021.

Ad Owe back tax 10K-200K. Ad BBB Accredited A Rating. End Your IRS Tax Problems - Free Consult.

Irs Installment Agreement Evanston Il M Financial Consulting Inc Payroll Taxes Irs Income Tax

Top Reasons For Irs Tax Audits Verifiche Fiscali Irs Taxes Debt Relief Programs Irs

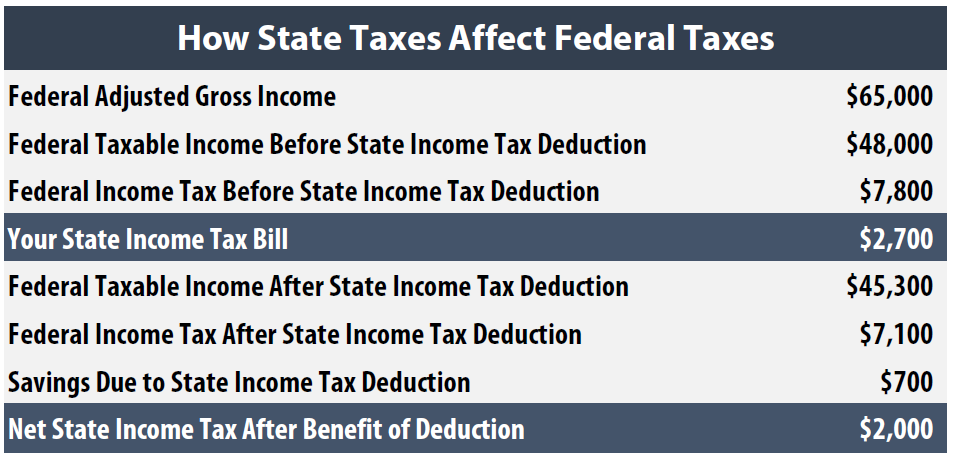

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules Tax Forms Irs Tax Forms Income Tax

How To Get Rid Of A Tax Lien Irs Taxes Tax Debt Irs

Fillable Form 1040 Individual Income Tax Return Income Tax Return Income Tax Tax Return

It Is Tax Season And People Will Be Getting Tax Returns Spend You Tax Return Wisely Tax Season Personal Finance Tax Return

How Do Child Support Offsets Affect Tax Refunds And Stimulus Checks Child Support Payments Tax Refund Debt

Currently Non Collectible Status Cnc Ny Ny 10035 Www Mmfinancial Org Irs Taxes Internal Revenue Service Irs

12 Reasons Why Your Tax Refund Is Late Or Missing

Do I Have To File State Taxes H R Block

Key Issues Tax Expenditures Types Of Taxes Infographic Tax

Tax Debt Help Austin Tx 78746 Debt Help Tax Debt Irs Taxes

How State Tax Changes Affect Your Federal Taxes A Primer On The Federal Offset Itep

:max_bytes(150000):strip_icc()/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)